A shorter version was published in the Boston Business Journal, March 18, 2016.

In this season of political hostility, a Democratic mayor and a Republican governor ran a unified campaign to persuade GE, America’s eighth-largest company, to move its headquarters to Boston. While that may be the biggest upset since the 2004 Red Sox playoff comeback to beat the Yankees, GE’s decision should not come as such a surprise.

Besides bipartisan harmony and the rich incentive package it fostered, several factors are repeatedly cited: new-economy talent, universities, quality of life. But there’s an unnoticed dimension, too. It can be found in the irony of a meeting across town on the same January day that the GE news buzzed across screens. Without fanfare, Michael Dell and Joe Tucci hosted EMC executives to prepare for history’s largest technology merger.

GE will bring 800 jobs and far more prestige and economic ripple than that number suggests. EMC, the state’s largest tech company, employs more than 10 times that many in Massachusetts. Even as part of Dell, it will be a major force in the region’s economy.

What GE and EMC have in common has been a hallmark of Boston’s innovation scene for more than a half century. Unlike Silicon Valley’s most famous brands, these are not consumer-tech companies. They sell on a massive, global scale to businesses, hospitals, governments and universities, which spend far more on technology than consumers do. With GE’s arrival, greater Boston is headquarters for eight Fortune 500 B2B companies. It’s not a stretch to call Boston the hub of the B2B universe. Already America’s largest B2B company, GE is no longer about refrigerators and light bulbs. Its digital transformation is well under way, aimed at big data analytics, the Internet of Things, and new technologies infused into everything from life sciences to clean energy. GE forecasts $20 billion in software revenue by 2020. Chairman and CEO Jeffrey Immelt will be in Boston April 4 to announce more details about the move.

GE’s TV campaign, “What’s the Matter with Owen?”, says as much about Boston vs. Silicon Valley as it does about B2B vs. consumer brands. In the ads, Owen is a young software developer trying to explain his new GE job to parents caught up in old stereotypes and friends focused on trivial new apps. “I’m gonna transform the way the world works,” Owen tells his incredulous friends. GE CMO Linda Boff told a Boston Ad Club audience that “Recruiting is up eightfold” since the ads began.

One reason Boston is more excited about GE than Owen’s friends is because so many iconic local companies have been acquired over the years by distant giants. Yet in their wakes are new businesses fueled by the alumni of the acquired companies; Massachusetts companies raised more venture capital in 2015 than any year on record. Akamai, Demandware, Hubspot, and LogMeIn play major roles in their respective corners of the digital economy. The next wave could include Actifio, Anaqua, Attend, CyberArk, Kaminario, Mimecast, Seismic, Simplivity, Smashfly, Veracode, and many others. Serial entrepreneurs Andy Ory and Patrick MeLampy feel so strongly about the region’s tech heritage and its impact on so many lives that they named their networking startup 128 Technology. “We’re coming to Boston because Boston is innovation,” said Boff.

Meanwhile, regeneration at scale is the rare trait that keeps GE and EMC vibrant. Lost on most people is the fact that EMC is not disappearing — it’s increasing in size and influence. Dell’s new enterprise division, based in Hopkinton, will have $30 billion in revenue – about double the size of the current EMC and big enough to be a Fortune 100 company.

As Michael Dell once said, “Ideas are a commodity. Execution of them is not.” Here in the hub of the B2B universe, we know that well.

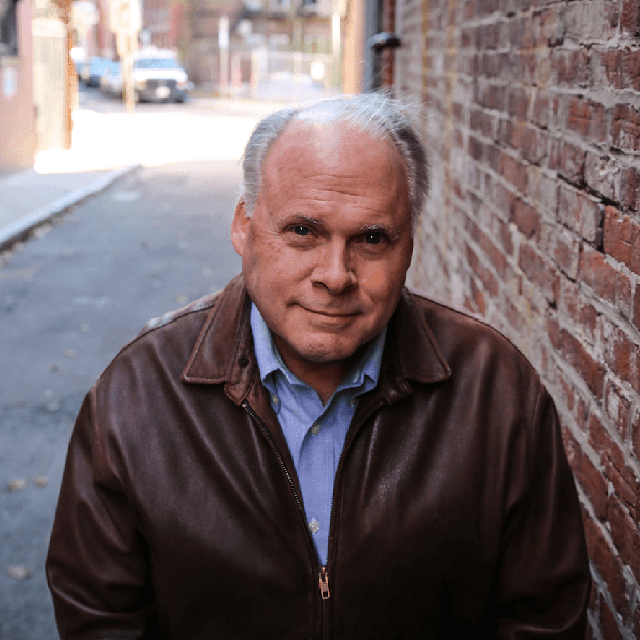

Mark Fredrickson is managing director of the technology practice at CTP. He spent 27 years with greater Boston tech titans Digital and EMC and now works with younger companies, including Greater Boston startups 128 Technology, Anaqua, Attend and Resilient Systems.